“Help, I need somebody!” It’s a popular song, but there are days when you truly need help. There are times when you are stuck in a place where you aren’t sure what to do. So, have you ever found yourself thinking, “I wonder if there is someone somewhere who can help me with this?” Well, you’re in luck because we have compiled a list of places that might be your light in a dark place. These are not infinite resources and they are based upon need as well as availability. ]

Clothing can be purchased here at a minimal fee.

Hours: Between the hours of 8:00am and 10:00am, you can receive a voucher for clothing on Tuesdays, Wednesdays and Thursdays. This voucher will allow you to get ten (10) items.

Our next topic and a very important topic it is. That would be FOOD.

Caritas Waco is a non-profit charitable agency chartered by the State of Texas. Its mission is “to provide urgent support to people in need in our community.” Caritas helps anyone who has emergency needs regardless of age, sex or ethnicity. The majority of recipients are residents of McLennan County although there are no geographical limits to receiving services from Caritas. All recipients are interviewed to determine their need.

Emergency/Supplemental Assistance is provided not only in Food, but also in the form of: Utilities, Clothing, Prescription Medication, Household Items as well as Travel Assistance.

Caritas Waco operates two Thrift Stores which are open to the public for low cost items. The two locations are:

In 2011, Caritas Waco served 24,420 families by providing them with 2,098,539 pounds of food. In June 2012, 2,116 families were served with food assistance totaling 137,018 pounds.

To become a Caritas client you need to show three forms of identification to the receptionist.

- Social Security Cards for everyone in your household,

- Proof of address ( rent or lease agreement / current utility bill), or

- Identification Card

Clients can receive food from Caritas once a month, clothing vouchers every four months, and utility payments once every two years. Homeless individuals can receive clothing once a month and food once a week.

You will be given a number to see an interviewer.

The Interview Process:

If you are a new client, the interviewer will explain Caritas’ services. You will be registered within our system and given a Caritas ID card. The interviewer determines what ways we would be able to aid you. Subsequent visits require your Caritas ID card and proof of address (current utility bill or anything mailed to your current address recently).

What about SHELTER? We didn’t quite know if there was a need for shelter, but maybe we can talk about HOUSING. So here goes.

The Obama Administration has implemented a number of programs to assist homeowners who are at risk of foreclosure and otherwise struggling with their monthly mortgage payments. The majority of these programs are administered through the U.S. Treasury Department and HUD. This page provides a summary of these various programs. Please continue reading in order to determine which program can best assist you.

Distressed homeowners are encouraged to contact their lenders and loan servicers directly to inquire about foreclosure prevention options that are available. If you are experiencing difficulty communicating with your mortgage lender or servicer about your need for mortgage relief, click here for information about organizations that can help contact lenders and servicers on your behalf.

Making Home Affordable

The Making Home Affordable © (MHA) Program is a critical part of the Obama Administration’s broad strategy to help homeowners avoid foreclosure, stabilize the country’s housing market, and improve the nation’s economy.

Homeowners can lower their monthly mortgage payments and get into more stable loans at today’s low rates. And for those homeowners for whom homeownership is no longer affordable or desirable, the program can provide a way out which avoids foreclosure. Additionally, in an effort to be responsive to the needs of today’s homeowners, there are also options for unemployed homeowners and homeowners who owe more than their homes are worth. Please read the following program summaries to determine which program options may be best suited for your particular circumstances.

Modify or Refinance Your Loan for Lower Payments

- Home Affordable Modification Program (HAMP): HAMP lowers your monthly mortgage payment to 31 percent of your verified monthly gross (pre-tax) income to make your payments more affordable. The typical HAMP modification results in a 40 percent drop in a monthly mortgage payment. Eighteen percent of HAMP homeowners reduce their payments by $1,000 or more. Click Here for more information.

- Principal Reduction Alternative (PRA): PRA was designed to help homeowners whose homes are worth significantly less than they owe by encouraging servicers and investors to reduce the amount you owe on your home. Click Here for more information.

- Second Lien Modification Program (2MP): If your first mortgage was permanently modified under HAMP SM and you have a second mortgage on the same property, you may be eligible for a modification or principal reduction on your second mortgage under 2MP. Likewise, If you have a home equity loan, HELOC, or some other second lien that is making it difficult for you to keep up with your mortgage payments, learn more about this MHA program. Click Here for more information.

- Home Affordable Refinance Program (HARP): If you are current on your mortgage and have been unable to obtain a traditional refinance because the value of your home has declined, you may be eligible to refinance through HARP. HARP is designed to help you refinance into a new affordable, more stable mortgage. Click Here for more information.

“Underwater” Mortgages

In today’s housing market, many homeowners have experienced a decrease in their home’s value. Learn about these MHA programs to address this concern for homeowners.

- Home Affordable Refinance Program (HARP): If you are current on your mortgage and have been unable to obtain a traditional refinance because the value of your home has declined, you may be eligible to refinance through HARP. HARP is designed to help you refinance into a new affordable, more stable mortgage. Click Here for more information.

- Principal Reduction Alternative: PRA was designed to help homeowners whose homes are worth significantly less than they owe by encouraging servicers and investors to reduce the amount you owe on your home. Click Here for more information.

- Treasury/FHA Second Lien Program (FHA2LP): If you have a second mortgage and the mortgage servicer of your first mortgage agrees to participate in FHA Short Refinance, you may qualify to have your second mortgage on the same home reduced or eliminated through FHA2LP. If the servicer of your second mortgage agrees to participate, the total amount of your mortgage debt after the refinance cannot exceed 115% of your home’s current value. Click Here for more information.

Assistance for Unemployed Homeowners

- Home Affordable Unemployment Program (UP): If you are having a tough time making your mortgage payments because you are unemployed, you may be eligible for UP. UP provides a temporary reduction or suspension of mortgage payments for at least twelve months while you seek re-employment. Click Here for more information.

- Emergency Homeowners’ Loan Program (EHLP), Substantially Similar States: If you live in Connecticut, Delaware, Idaho, Maryland, or Pennsylvania, Click Here for more information about EHLP assistance provided in your state.

- FHA Forbearance for Unemployed Homeowners: Federal Housing Administration (FHA) requirements now require servicers to extend the forbearance period for unemployed homeowners to 12 months. The changes to FHA’s Special Forbearance Program announced in July 2011 require servicers to extend the forbearance period for FHA borrowers who qualify for the program from four months to 12 months and remove upfront hurdles to make it easier for unemployed borrowers to qualify. Click Here for more information.

Managed Exit for Borrowers

- Home Affordable Foreclosure Alternatives (HAFA): If your mortgage payment is unaffordable and you are interested in transitioning to more affordable housing, you may be eligible for a short sale or deed-in-lieu of foreclosure through HAFA SM. Click Here for more information.

- “Redemption”is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Click Here for more information.

CONTACT FHA

FHA staff are available to help answer your questions and assist you to better understand your options as an FHA borrower. There are several ways you can contact FHA for more information, including:

- Call the NSC at (877) 622-8525

- Call the FHA Outreach Center at 1-800-CALL FHA (800-225-5342)

- Persons with hearing or speech impairments may access this number via TTY by calling the Federal Information Relay Service at (800) 877-8339.

For those times when you need help with FINANCIAL ASSISTANCE or other related things, such as bills, utilities, etc., here is a little help.

BELLMEAD CALVARY BAPTIST CHURCH

912 East Loop 340

Waco, TX 76705

Phone: 254.799.0229

Website: www.bellmeadcalvary.org

Bill Payment

Services: When funds are available, they will pay for the last $25 of one of the client’s bills

Stipulations: Bring proof of residence and photo I.D.

HIGHLAND BAPTIST CHURCH

THE CARE CENTER

Phone: 254.754.8923

Hours: Monday-Thursday and Tuesday: 7pm-8:30pm

Services: Food, clothing, bill assistance with ATMOS gas, TXU, and Waco water, prescription assistance, transportation assistance for out of town medical appointments

How to Apply: Client must fill out application, return application to Care Center, staff will then call client to make appointment. Walk-ins are taken Tuesday evenings 7pm-8:30pm after appointments. Help client fill out application and mail in. Applications are only accepted Wednesday through Sunday, application time Monday thru Thursday: 1-5pm

Stipulations: Must have appointment, utilities assistance is for termination notice only, does not assist with rent

CARITAS

300 S. 15th Street

Waco, TX 76701

Phone: 254.753.4593

Fax: 254.752.4434

Email: caritas@calpha.com

Website: www.caritas-waco.org

Services: Provides emergency/supplemental assistance in the form of food (once a month), clothing (once every 3 months), household items, utility, mediation, rent and mortgage, and travel assistance (eligibility requirements), utilities $55-65, food distribution, and can assist with furniture, assistance with application for Food Stamps and TANF (Temporary Assistance for Needy Families).

Stipulations: Help varies with income. Know your income and expenses. Food Stamps, TANF, and SSI recipients automatically qualify. Client should have photo ID and proof of address (unless homeless) and SS #. To receive assistance with a bill, it must be a termination notice or eviction notice.

How to Apply: For assistance with anything other than a bill, client can go to Caritas with necessary documents Monday-Friday: 8am-3pm; household goods Monday-Wednesday: 8am-12pm. Clients are served on a first come first serve basis and must wait to be seen by an interviewer. For assistance with a bill, call Linda Chavez to set up an appointment for the client.

Food Voucher Store

Phone: 254.753.0125

How to Apply:If possible, call first to set up appointment.

Hours: Monday-Friday: 8:30am-4:30pm

CENTRAL PRESBYTERIAN CHURCH

9191 Woodway Dr.

Waco, TX 76712

Phone: 254.754.3544

Hours: Monday-Friday: 9am-2pm

Services: Utilities and food assistance

ECONOMIC OPPORTUNITIES ADVANCEMENT CORPORATION (EOAC)

512 Franklin

Waco, TX 76701

Phone: 254.756.0954

Services: Financial assistance with utility bills-electric, water, gas and assistance with rent.

How to Apply: EOAC generally needs to see the clients themselves, you can call to be sure they currently have funds or when funds will be available.

Hours: Monday-Friday: 8am-5pm

Services: Utility and Rental Assistance Program, can assist with electricity bill

Stipulations: Must be McLennan County

EOAC Neighborhood Services Center

Assistance with utilities (Utility and Rental Assistance Program)

932 N. 9th St.

Phone: 254.756.0954

Has three apartment units for the Self-Sufficiency Program for parents and children. Person in this program stays 30-90 days (jobs in two weeks). The program lasts about 12 months. Helps with transition into a new apartment, pays first month’s rent, tuition for two classes. Also pays for GED, and for certification tests. Emergency services, employment referrals, housing information, emergency financial aid for utility bills, rental assistance.

Hours: Open Monday-Friday: 8am-5pm

Sees clients Monday-Thursday

FIRST BAPTIST CHURCH WACO

500 Webster

Waco, TX 76706

Phone: 254.752.3000

Website: www.fbcwaco.org

Benevolence Ministry

254.754.3503

Services: Emergency fuel assistance, transportation assistance (bus/gas vouchers), food (HEB cards), medication assistance, flexible as to what services can be provided, referrals and case management

How to Apply: Assist client with setting up an appointment

Stipulations: Client needs to have an appointment to receive assistance, appointments are usually made for afternoons, client also needs a valid Driver’s License and a phone number or other means of being able to contact the client in case appointments change, they usually require that appointments be set on Mondays for the next appointment day, but sometimes they make exceptions (just call) School Uniforms make appointments with the Benevolence Coordinator

Agape Meal

Fellowship Hall on 6th and Clay

Once a month, last Tuesday of the month

Dinner: 6pm-7pm

Bible Study: 7pm-7:30pm

LAKE SHORE BAPTIST CHURCH

5801 Bishop Dr.

Waco, TX 76710

Phone: 254.772.2910

Fax: 254.772.2914

Website: www.lakeshorewaco.org

Utilities/rent: Help with approximately $350 per month for utilities, rent, etc.(generally in $50 amounts) distributed through recommendation by social workers at area agencies or congregations.

SALVATION ARMY

1224 Connor St.

Waco, TX 76703 (located on access road on west side of I 35, south of 12th street)

Phone: 254.752.7261

Services: Provides financial assistance one time only, furniture and clothing will only be provided in verifiable crisis situations, food (upon verifiable need), pay up to 85% of utility bill or rent, voucher for half off in thrift store, Christian Crisis Intervention counseling

How to Apply: Call office – secretary will do a background check on previous services provided to the client and set up an appointment for the client if they are able to help.

Stipulations: Client must have verifiable emergency – Red Cross referral, fire report, police report, some sort of documentation of the emergency, client must have ID and Social Security number and proof of income, clients must be residents of McLennan County.

SEVENTH DAY ADVENTIST CHURCH

800 W. Hwy 6

Waco, TX 76712

Phone: 254.772.7815

Website: http://waco22.adventistchurchconnect.org

Community Center

How to Apply: come to center if need service

Hours: Tuesdays: 1pm-5pm

Services: assistance with utility bills, food, clothing, and hygiene products.

SEVENTH & JAMES BAPTIST CHURCH

602 James Avenue

Waco, TX 76706

Phone: 254.753.6425

Fax: 254.753.1909

Website: www.seventhandjames.org

Email: mail@seventhandjames.org

How to Apply: Call church office and speak to Valerie, basic application can be filled out over the phone a physical visit is not necessary.

Services: Gas, water, rent, Medication Assistance Program (MAP), Meals-on- Wheels, Seeds of Hope

Stipulations: NOT electricity

ST. FRANCIS CATHOLIC CHURCH

301 Jefferson Ave.

Waco, TX

Mailing: 315 Jefferson St.

Waco, TX 76701

Phone: 254.752.8434 (Main)

254.754.1012 (Rectory)

254.752.1159

254.752.3434

Services: Food, Clothing, Financial Assistance

Also, for Electric Service Payment Assistance, go to www.211texas.org.

The next topic we have is UNEMPLOYMENT INSURANCE BENEFITS. This is a very important topic as this involves your money.

Our next topic of discussion is EDUCATION.

The State of Texas administers a program called The Workforce Investment Act of 1998. The purpose of this program is:

>To increase job opportunities, retention on the job and the earnings for eligible participants

>To increase the occupational skill attainment of eligible participants

>To assist eligible participants to overcome barriers to employment and training

The Worker Investment Act of 1998 reformed federal employment, training, adult education and vocational rehabilitation programs by creating an integrated “one-stop” system of workforce investment and education services for adult, dislocated workers and youth.

The basic adult eligibility requirements are:

- Citizenship or eligible non-citizen

- Age 18 years of age or over

- Selective Service Registration

- Meet income requirements

Eligibility Requirements for Dislocated Workers are:

- Citizenship or eligible non-citizen

- Selective Service Registration

- Dislocated Worker Status

>Terminated, laid off or received notice of lay-off

>Self-Employed and unemployed due to general economic conditions or natural disaster

>Displaced Homemaker

Remember that before you attempt to contact a WIA counselor, be sure that you have registered in WorkInTexas at www.workintexas.com.

WIA counselors work by appointments ONLY. Ask for a WIA Packet at the front desk of the Workforce Center at 1416 South New Road in Waco, Texas. Once you have completed that packet, give it to the Receptionist at the front desk and she will submit to the WIA Unit. A counselor will then review your packet and call you to schedule an intake appointment. If you have any questions, please call 254/296-5210 and ask for the WIA Unit.

Locally, there are people who you can speak with regarding your benefits right at your workforce center. The Workforce Solutions for the Heart of Texas Workforce Center at 1416 South New Road houses an Unemployment Insurance Unit. These individuals are very knowledgeable and helpful with regard to many of your unemployment questions or concerns. They are very friendly and don’t hesitate to help when the need arises. Just call the local Workforce Center Office at 254-296-5310 and ask for the UI Unit.

We have a couple more things to share with you. One of these is MISSION WACO. This organization has invaluable resources and services available to the community. Please check it out and take advantage of the wonderful opportunities they provide. Here are just a few.

Mission Waco Health Clinic

Mission Waco also provides services for acute healthcare needs. Dental screenings and chiropractic services are also provided twice per month. All patients must meet the following requirements: Household income is less than 200% of the Federal Poverty Guidelines and are currently not carrying any form of Health Insurance; income verification will be required. Patients are served on a first come, first served basis.

Hours are: Tuesdays from 5:00-7:00pm; Thursdays from 5:00-7:00pm

It is located at 1226 Washington Avenue Tel: 254/296-9866, X206

Email: Leigh Saxon and Georgeen Scanes, co-coordinators

Christmas Toy Store

On select days in early December, Mission Waco affords low-income families the opportunity to purchase new Christmas toys and gift items for their children, at an 80% discount off the retail price! (Parent is paying only 20% of the cost). Last year’s Toy Store served over 550 families who shopped for more than 1700 children! 320 Volunteers donated 1414 hours to prepare and operate the store!

In addition to this service, Mission Waco also offers free onsite gift wrapping to the shoppers. For more information, call Kathy Wise or Joyce Brammer or call 254/753-4900.

SER Waco

Senior Community Service Employment Program (SCSEP) provides training opportunities for people 55 or older who are unemployed and need to refresh or learn new skills to return to work. If you live in McLennan, Hill, or Ellis county and are low-income, you may qualify for this program. Follow the link Applicant Forms to find an application and a Participant handbook. If you are interested, then complete and mail in your application to 400 South 4th Street, Waco, Texas. They look forward to helping you return to work!

Okay, this is the final thing we are going to share with you this time around. It is called The KAHN ACADEMY. The Kahn Academy is a website that offers assistance to individuals who are having difficulty in their studies, so this could be useful to you as well as to your children, or anybody you know who is experiencing difficulties in completing their school work. Here’s the info: www.khanacademy.org.

This website tells it all. Go ahead; try it. You will be amazed. It covers subjects in:

Algebra

American Civics

Arithmetic and Pre-Algebra

Art History

Banking and Money

Biology

Brain Teasers

Brit Cruise

CAHSEE Example Problems

Calculus

Chemistry

Competition Math

Computer Science

Cosmology and Astronomy

Credit Crisis

Currency

Current Economics

Differential Equations

Finance

GMAT (Graduate Management Admission Test)

Geithner Plan

Geometry

Healthcare and Medicine

History

Macroeconomics and Microeconomics

Physics

Precalculus

Probability

SAT Preparation

Statistics

Trigonometry

Venture Capital and Capital Markets and so much more…..

Take note, that needing these resources does not say anything about you. We all need help at one time or another. It’s what you do with the resources that are given to you that make the difference. We hope these resources help you make it until that next job.

Good Luck! △

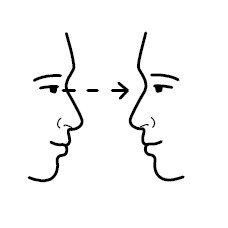

think that everyone has been through this at least once on a daily basis. There is a difference between hearing someone and listening to them. Hearing is just picking up vibrations, but listening is interpreting and making sense of what we hear. Everyone is guilty of being the person in the conversation that just hears, but doesn’t actually listen to others from time to time. For those of you who struggle with being active listeners, you need to make a conscious effort to improve this important skill because when people start to pick up on the fact that you aren’t listening to what they have to say, this could have a negative effect on you more than them. For instance, others may not have too much confidence in you because you never listen to their ideas or opinions and you might give the impression that you are too rigid in your thinking. If you are a manager or a supervisor, then, you really need to actively listen to your employees. Think of it this way — If you are not actually listening to your employees, then, how can you help them by providing decent feedback to improve their efficiency on how they perform at work?

think that everyone has been through this at least once on a daily basis. There is a difference between hearing someone and listening to them. Hearing is just picking up vibrations, but listening is interpreting and making sense of what we hear. Everyone is guilty of being the person in the conversation that just hears, but doesn’t actually listen to others from time to time. For those of you who struggle with being active listeners, you need to make a conscious effort to improve this important skill because when people start to pick up on the fact that you aren’t listening to what they have to say, this could have a negative effect on you more than them. For instance, others may not have too much confidence in you because you never listen to their ideas or opinions and you might give the impression that you are too rigid in your thinking. If you are a manager or a supervisor, then, you really need to actively listen to your employees. Think of it this way — If you are not actually listening to your employees, then, how can you help them by providing decent feedback to improve their efficiency on how they perform at work? acknowledgement. Another way you can express you are listening is to give affirmative head nods or appropriate facial expressions. Giving appropriate facial expressions means that if the person talking to you looks sad, then, you need to make an effort to mirror their face by making a sad expression and the same goes with other types of expressed emotions. You don’t necessarily have to feel what they are feeling, however, making similar facial expressions shows empathy. A person who doesn’t listen cannot show appropriate facial expressions in relation to what others are saying because they aren’t interpreting or finding meaning in anything others say. It is okay to ask questions or paraphrase what the speaker is saying because it shows that you’re taking an initiative in trying to understand what the speaker is talking about. You should always avoid interrupting the speaker because you are getting ahead of yourself. Wait until the speaker finishes what they have to say in order for you to digest it and

acknowledgement. Another way you can express you are listening is to give affirmative head nods or appropriate facial expressions. Giving appropriate facial expressions means that if the person talking to you looks sad, then, you need to make an effort to mirror their face by making a sad expression and the same goes with other types of expressed emotions. You don’t necessarily have to feel what they are feeling, however, making similar facial expressions shows empathy. A person who doesn’t listen cannot show appropriate facial expressions in relation to what others are saying because they aren’t interpreting or finding meaning in anything others say. It is okay to ask questions or paraphrase what the speaker is saying because it shows that you’re taking an initiative in trying to understand what the speaker is talking about. You should always avoid interrupting the speaker because you are getting ahead of yourself. Wait until the speaker finishes what they have to say in order for you to digest it and see the whole picture. Avoid doing distracting gestures like looking around while the speaker is talking or texting on your cell phone because it is rude and it makes it awkward for the speaker, in any situation. Do not over talk because when people do this, they tend to dominate the conversation and that isn’t fair to the speaker, especially the type of speaker that rarely speaks up at all.

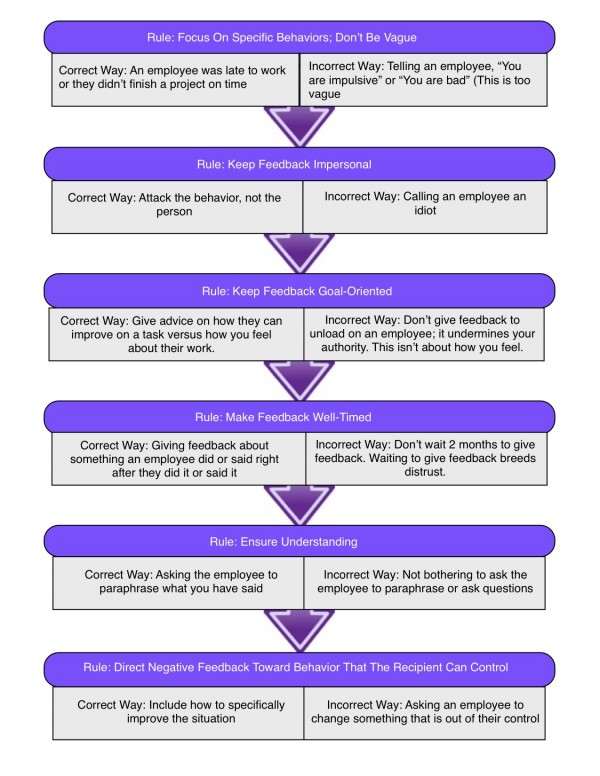

see the whole picture. Avoid doing distracting gestures like looking around while the speaker is talking or texting on your cell phone because it is rude and it makes it awkward for the speaker, in any situation. Do not over talk because when people do this, they tend to dominate the conversation and that isn’t fair to the speaker, especially the type of speaker that rarely speaks up at all. feedback to their employees. Sixty percent of U.S. and European companies have identified poor or ineffective feedback as the primary cause of insufficient employee performance. The table below will list rules of how to provide feedback along with examples to give you further explanation of the rules.

feedback to their employees. Sixty percent of U.S. and European companies have identified poor or ineffective feedback as the primary cause of insufficient employee performance. The table below will list rules of how to provide feedback along with examples to give you further explanation of the rules.