by cjxpadmin | Oct 30, 2012 | Job Readiness, November 2012 Magazine

by Erica Mitchell-Breedlove

In my Human Resources (HR) profession, I review anywhere from 80 – 1,500 employment applications on a weekly basis. Most applications are accompanied by additional precious employment documents, i.e. resumes, cover letter, vitas. It is when I actually have the opportunity to speak to interested candidates where an applicant’s “Blind Opponent” reveals itself in one of our mini visitations; thereby, making our meeting of two a threesome.

basis. Most applications are accompanied by additional precious employment documents, i.e. resumes, cover letter, vitas. It is when I actually have the opportunity to speak to interested candidates where an applicant’s “Blind Opponent” reveals itself in one of our mini visitations; thereby, making our meeting of two a threesome.

You see, it is during such visits where an applicant breathlessly initiates a well-practiced pitch to describe their endless employment experience, number of awards received and degrees earned while also preparing for their conversation finale to push 2 or 3 versions of well tailored resumes and exclaim, “Do you have a job for me?” The applicant has good intentions to get the attention of the employer by distinguishing themselves from all others and closing on the sale to get a job, any job, just a job! However, the employer is distracted by the presence of the Blind Opponent, the applicant!

For this Blind Opponent cannot see the viewpoint of an employer, they can only see their purpose. The Blind Opponent  appears desperate, tunnel-visioned and sometimes pushy for they are blind to the employer’s applicant processes, availability of jobs and they, most often, lack the knowledge of who the hiring decision-makers are within an organization. Current and future job opportunities are often talked away and, in most cases, right out of an applicant’s reach because the applicant replaces themselves with their Blind Opponent to speak on their behalf without first asking questions and listening to the employer.

appears desperate, tunnel-visioned and sometimes pushy for they are blind to the employer’s applicant processes, availability of jobs and they, most often, lack the knowledge of who the hiring decision-makers are within an organization. Current and future job opportunities are often talked away and, in most cases, right out of an applicant’s reach because the applicant replaces themselves with their Blind Opponent to speak on their behalf without first asking questions and listening to the employer.

Avoid letting others such as a Blind Opponent speak on your behalf. Re-position your thought process and ask yourself, “What does the employer seek in an ideal candidate?” as opposed to assuming they want whatever you present. Attempt to create opportunities to do the following:

① Secure a 10-Minute Meet-n-Greet Informational Meeting/Interview

To accomplish this task, ask for a 10-minute meet and greet informational meeting/interview. This can be accomplished in person or by phone. Let the employer know that you just want to gather a little more information about their employment processes. Employers feel more comfortable about speaking to applicants outside of their regular processes when they are made aware of the purpose of the meeting and the amount of time you are requesting; therefore, be courteous of their schedule by staying within the requested timeframe when you land such a meeting. Remember, ten minutes!

② Learn Something New

Prepare in advance two open-ended questions that will provide you with information that you previously did not know about the organization’s employment processes, or about the organization itself. It can be helpful to understand who is responsible for reviewing applications, making hiring decisions and if their organization utilizes hiring timelines. Avoid asking closed-ended yes/no questions.

Prepare in advance two open-ended questions that will provide you with information that you previously did not know about the organization’s employment processes, or about the organization itself. It can be helpful to understand who is responsible for reviewing applications, making hiring decisions and if their organization utilizes hiring timelines. Avoid asking closed-ended yes/no questions.

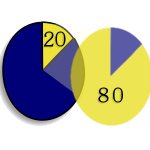

③ Get the Attention of the Employer

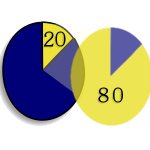

To gain positive attention, give the employer 80% talk time. The applicant should take no more than 20% talk time in an employer meet-n-greet informational meeting/interview. This percentage time would be reversed if it were an actual interview; however, this is just an initial meet-n-greet meeting. Employers are pleased whenever they find applicants who take an avid interest in their organization. When applicants approach employers about meetings to discuss specific job openings, employers typically become hesitant for they don’t want to be accused of disproportionately providing information to applicants amongst an applicant pool. So when asked about job openings, the employer will most likely begin rehearsing their commonly used response as to how the applicant may navigate through their website to get additional information. However, most employers love to share how they landed their jobs and how they recruit their best employees. Don’t assume you will get a job with an initial meet-n-greet meeting. Your goal is to gain a positive memorable experience.

To gain positive attention, give the employer 80% talk time. The applicant should take no more than 20% talk time in an employer meet-n-greet informational meeting/interview. This percentage time would be reversed if it were an actual interview; however, this is just an initial meet-n-greet meeting. Employers are pleased whenever they find applicants who take an avid interest in their organization. When applicants approach employers about meetings to discuss specific job openings, employers typically become hesitant for they don’t want to be accused of disproportionately providing information to applicants amongst an applicant pool. So when asked about job openings, the employer will most likely begin rehearsing their commonly used response as to how the applicant may navigate through their website to get additional information. However, most employers love to share how they landed their jobs and how they recruit their best employees. Don’t assume you will get a job with an initial meet-n-greet meeting. Your goal is to gain a positive memorable experience.

④ Apply What You Learn

Apply what you have learned, thus far, from what the employer has communicated with you during the meeting and  utilize whatever time you have remaining (of your 20% talk time) to pitch your valuable work experience. Employers are very impressed when it appears you have listened to them. Even when an employer gives information that does not sound promising, stay positive and close the meeting with presenting your resume and a quick pitch about your work experience that summarizes why you are a viable candidate. Be organized and very clear in your speech. Provide eye contact and don’t forget to smile.

utilize whatever time you have remaining (of your 20% talk time) to pitch your valuable work experience. Employers are very impressed when it appears you have listened to them. Even when an employer gives information that does not sound promising, stay positive and close the meeting with presenting your resume and a quick pitch about your work experience that summarizes why you are a viable candidate. Be organized and very clear in your speech. Provide eye contact and don’t forget to smile.

Good Luck! Δ

by cjxpadmin | Oct 30, 2012 | Job Readiness, November 2012 Magazine

by Sheena Williams

We are not doctors, but having had a few colds around the office, we know that working with a runny nose and a fever is no fun for anyone! So in the interest of cold season coming up, we thought it would be nice (and self-serving because we needed this information too) if we gave out some ways to keep colds and flu away, because apples aren’t cutting it, and our doctors are tired of seeing us!

Wash Your Hands. We cannot say this enough! Washing your hands  keeps colds and other infections away. Warm water and soap are two of your body’s best weapons against the flu. Make sure you wash your hands for at least 30 seconds to make sure they are as clean as you can get them. If you can’t get to a sink to wash your hands, grab some hand sanitizer. If you’ve shaken hands or touched a surface you know hundreds of people have had their hands on all day, don’t put your hands near your mouth or eyes until you can clean or sanitize them.

keeps colds and other infections away. Warm water and soap are two of your body’s best weapons against the flu. Make sure you wash your hands for at least 30 seconds to make sure they are as clean as you can get them. If you can’t get to a sink to wash your hands, grab some hand sanitizer. If you’ve shaken hands or touched a surface you know hundreds of people have had their hands on all day, don’t put your hands near your mouth or eyes until you can clean or sanitize them.

Exercise. Working out is not just for getting rid of those pesky holiday pounds. It’s also excellent for keeping colds and flu away. Exercise strengthens your heart and kicks your immune system into drive. Just 30 minutes a day is like training your sickness-fighting-army to beat and kick colds to the curb and let you get to work runny nose-free!

Exercise. Working out is not just for getting rid of those pesky holiday pounds. It’s also excellent for keeping colds and flu away. Exercise strengthens your heart and kicks your immune system into drive. Just 30 minutes a day is like training your sickness-fighting-army to beat and kick colds to the curb and let you get to work runny nose-free!

Home Remedies and Herbal Remedies. This section is  beyond the scope of our humble publication, so we suggest going to your doctor or local pharmacist to have them advise you on natural remedies and vitamins that you can take to keep your chances of catching a cold down. This also goes for vitamin C. Always check with your doctor before trying anything new or if you’re going to take up any routine that may affect your health.

beyond the scope of our humble publication, so we suggest going to your doctor or local pharmacist to have them advise you on natural remedies and vitamins that you can take to keep your chances of catching a cold down. This also goes for vitamin C. Always check with your doctor before trying anything new or if you’re going to take up any routine that may affect your health.

Doctors. I know this article is supposed to be about preventing being sick so you  don’t have to go, but seeing your doctor is one of the best ways to prevent getting colds and helping to prevent the flu. They can recommend options that the normal lay person can’t. He/She can advise you on the latest shots and medicines that you can take that will be appropriate for you. If you don’t have a personal physician, go to your clinic, student service nurse, work nurse and ask them what you should do.

don’t have to go, but seeing your doctor is one of the best ways to prevent getting colds and helping to prevent the flu. They can recommend options that the normal lay person can’t. He/She can advise you on the latest shots and medicines that you can take that will be appropriate for you. If you don’t have a personal physician, go to your clinic, student service nurse, work nurse and ask them what you should do.

Chicken Soup. Don’t wave off your grandma when she brings in a bowl of soup.  She’s not just good for cookies and warm hugs. Not only is the ingredients in this well known food stuff good for you, they are chocked full of vitamins. The warm steam from chicken soup alone will help with clearing your head. Yum!

She’s not just good for cookies and warm hugs. Not only is the ingredients in this well known food stuff good for you, they are chocked full of vitamins. The warm steam from chicken soup alone will help with clearing your head. Yum!

Get Plenty of Rest. This is another item on this list we can’t stress enough. Getting enough rest is key in keeping colds and flu away. Your body is bombarded with so much stress, and late nights of studying is pushing it to the limit of what can reasonably be expected. Your body needs sleep to get itself together and keep your immune system in cold fighting order.

Get Plenty of Rest. This is another item on this list we can’t stress enough. Getting enough rest is key in keeping colds and flu away. Your body is bombarded with so much stress, and late nights of studying is pushing it to the limit of what can reasonably be expected. Your body needs sleep to get itself together and keep your immune system in cold fighting order.

Drink Plenty of Water. Staying hydrated is another way of keeping yourself in  working order. Water keeps your body lubricated. Think of it as giving your car oil. Water is to your body as oil is to your car. Water is your body’s way of keeping all of your immune systems (parts) in excellent working order!

working order. Water keeps your body lubricated. Think of it as giving your car oil. Water is to your body as oil is to your car. Water is your body’s way of keeping all of your immune systems (parts) in excellent working order!

Just remember that when you’re out and about, you need to be vigilant about where you put your hands, how well you wash your hands, how much water you consume and how much rest you get! There are colds and flu all over the place looking for a home, and with a little work, you can be ready for anything the cold and flu season throw at you! Δ

by cjxpadmin | Sep 18, 2012 | Octobe r2012 Magazine, This Issue's FEATURE

by Marrisa Maldonado

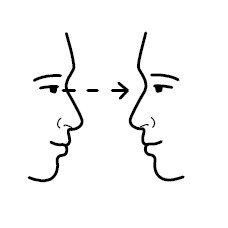

There are two key oral communication skills that most people struggle with and they are active listening and providing feedback. Have you ever had a discussion with someone and told them, “Hey, you’re not listening to me!” even though they have a response to everything you say? I  think that everyone has been through this at least once on a daily basis. There is a difference between hearing someone and listening to them. Hearing is just picking up vibrations, but listening is interpreting and making sense of what we hear. Everyone is guilty of being the person in the conversation that just hears, but doesn’t actually listen to others from time to time. For those of you who struggle with being active listeners, you need to make a conscious effort to improve this important skill because when people start to pick up on the fact that you aren’t listening to what they have to say, this could have a negative effect on you more than them. For instance, others may not have too much confidence in you because you never listen to their ideas or opinions and you might give the impression that you are too rigid in your thinking. If you are a manager or a supervisor, then, you really need to actively listen to your employees. Think of it this way — If you are not actually listening to your employees, then, how can you help them by providing decent feedback to improve their efficiency on how they perform at work?

think that everyone has been through this at least once on a daily basis. There is a difference between hearing someone and listening to them. Hearing is just picking up vibrations, but listening is interpreting and making sense of what we hear. Everyone is guilty of being the person in the conversation that just hears, but doesn’t actually listen to others from time to time. For those of you who struggle with being active listeners, you need to make a conscious effort to improve this important skill because when people start to pick up on the fact that you aren’t listening to what they have to say, this could have a negative effect on you more than them. For instance, others may not have too much confidence in you because you never listen to their ideas or opinions and you might give the impression that you are too rigid in your thinking. If you are a manager or a supervisor, then, you really need to actively listen to your employees. Think of it this way — If you are not actually listening to your employees, then, how can you help them by providing decent feedback to improve their efficiency on how they perform at work?

You can become an active listener by making eye contact with others when they speak. In American culture, we expect people to make eye contact because it is a sign of respect and  acknowledgement. Another way you can express you are listening is to give affirmative head nods or appropriate facial expressions. Giving appropriate facial expressions means that if the person talking to you looks sad, then, you need to make an effort to mirror their face by making a sad expression and the same goes with other types of expressed emotions. You don’t necessarily have to feel what they are feeling, however, making similar facial expressions shows empathy. A person who doesn’t listen cannot show appropriate facial expressions in relation to what others are saying because they aren’t interpreting or finding meaning in anything others say. It is okay to ask questions or paraphrase what the speaker is saying because it shows that you’re taking an initiative in trying to understand what the speaker is talking about. You should always avoid interrupting the speaker because you are getting ahead of yourself. Wait until the speaker finishes what they have to say in order for you to digest it and

acknowledgement. Another way you can express you are listening is to give affirmative head nods or appropriate facial expressions. Giving appropriate facial expressions means that if the person talking to you looks sad, then, you need to make an effort to mirror their face by making a sad expression and the same goes with other types of expressed emotions. You don’t necessarily have to feel what they are feeling, however, making similar facial expressions shows empathy. A person who doesn’t listen cannot show appropriate facial expressions in relation to what others are saying because they aren’t interpreting or finding meaning in anything others say. It is okay to ask questions or paraphrase what the speaker is saying because it shows that you’re taking an initiative in trying to understand what the speaker is talking about. You should always avoid interrupting the speaker because you are getting ahead of yourself. Wait until the speaker finishes what they have to say in order for you to digest it and see the whole picture. Avoid doing distracting gestures like looking around while the speaker is talking or texting on your cell phone because it is rude and it makes it awkward for the speaker, in any situation. Do not over talk because when people do this, they tend to dominate the conversation and that isn’t fair to the speaker, especially the type of speaker that rarely speaks up at all.

see the whole picture. Avoid doing distracting gestures like looking around while the speaker is talking or texting on your cell phone because it is rude and it makes it awkward for the speaker, in any situation. Do not over talk because when people do this, they tend to dominate the conversation and that isn’t fair to the speaker, especially the type of speaker that rarely speaks up at all.

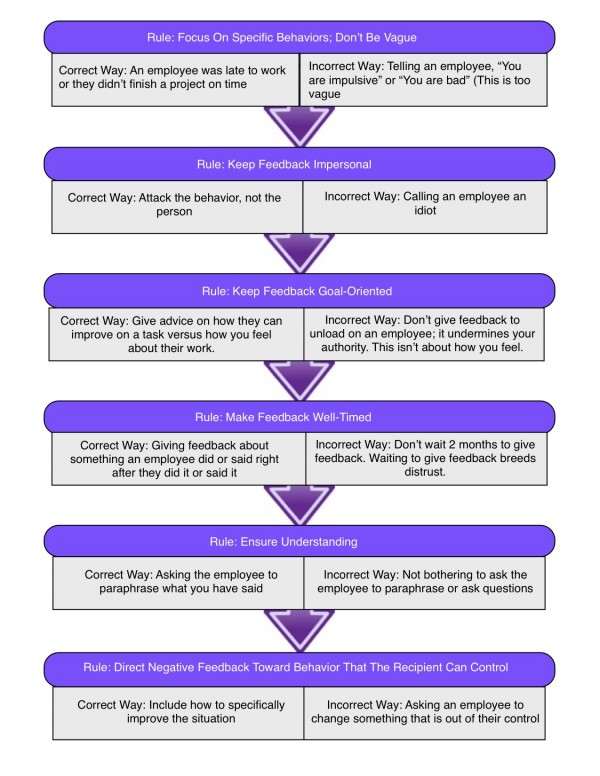

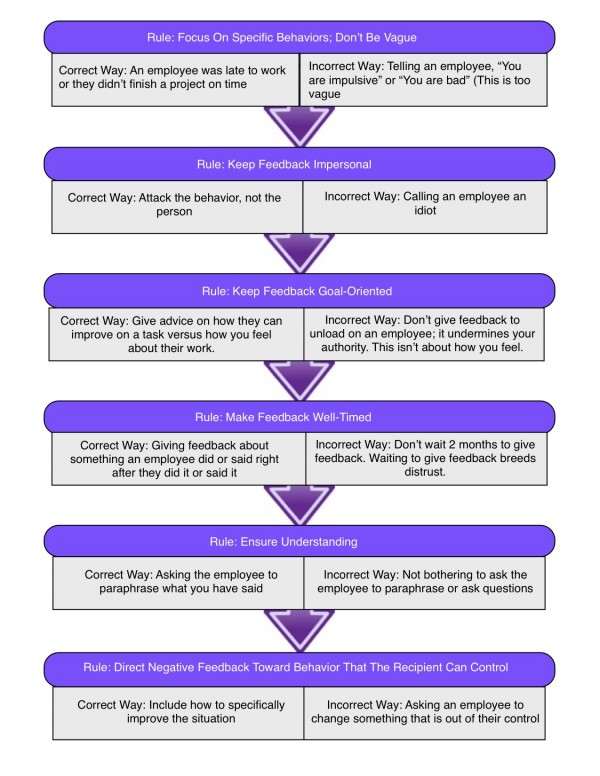

Providing feedback is definitely the hardest communication skill to work on for a number of reasons. People usually make the mistake in attacking attributes that are out of a person’s control or unloading on a person. Giving feedback is the most important task for managers to deal with. Managers, in general, do not provide  feedback to their employees. Sixty percent of U.S. and European companies have identified poor or ineffective feedback as the primary cause of insufficient employee performance. The table below will list rules of how to provide feedback along with examples to give you further explanation of the rules.

feedback to their employees. Sixty percent of U.S. and European companies have identified poor or ineffective feedback as the primary cause of insufficient employee performance. The table below will list rules of how to provide feedback along with examples to give you further explanation of the rules.

Review the table and choose which rules you struggle with the most because even if you are great at doing some of the rules listed, there is always room for improvement. In my opinion, I would say most people probably struggle with the second and the last rule. I encourage you guys to discuss which rules you feel you struggle with the most when providing feedback and think about why you struggle with these specific rules. Some of you might struggle with all of the rules listed above while others might only struggle with one or two of the rules. Either way you look at it, you can use the examples to your advantage. Which rules do you see being broken most often by yourself or by your co-workers? Do you agree with these rules? Do you have managers who break the majority of the feedback rules?

Another question is do you realize that your manager is breaking one of these rules when interacting with you, then, what is the correct way to discuss these realizations with your manager or boss? Do you think your superiors would actively listen to what you had to say? Hmm………………. △

by cjxpadmin | Sep 18, 2012 | Octobe r2012 Magazine, This Issue's FEATURE

by Melvin Collins, Jr

Have you ever received your paycheck at the end of a grueling work period and you take a peek at your earnings and you just want to ask, “Who is this guy FICA and why is he taking my money?”

We are going to take a look at a typical paycheck and go over each section to see where our money is going every payday. Many people have been receiving paychecks all of their adult life, but, you would be amazed at how many people don’t even pay attention to their pay stub. Sometimes, they don’t even keep their pay stub. Do you? Well, you should (for income tax purposes).

A paycheck consists of two parts: the paycheck part and the paycheck stub part. The paycheck part, of course, as you know, is what you take to the bank and deposit into your account to use for your daily living expenses. The paycheck stub part will include a breakdown of your earnings and deductions for a pay period to illustrate how your employer has arrived at your net pay. It will have a list of everything you earned and everything they are taking out of your paycheck. It will also contain your personal information such as: your name, your address, your Social Security Number, your sick leave, vacation time, and perhaps even your date of birth, as well as your gross pay, your net pay and your deductions.

Let’s take those one at a time, okay? Aside from the personal information, oh by the way, with a word about your personal information, make sure that it is CORRECT. That’s right, sometimes the Payroll Department may have misinformation on you, particularly and most important your Social Security Number. Also make sure they have your correct contact information — mailing address, telephone number, etc. Now, back to Gross Pay. Here we go…

Your Gross Pay — Your gross pay is the total amount of money that you earned during a certain pay period, be it weekly, hourly, monthly or semi-monthly.

Net Pay — Your net pay is the amount of money that is left after all your deductions have been taken out of your paycheck.

Deductions — The deductions contain a whole other slew of information. It is a breakdown of everything that you pay for out of your paycheck. This will include regular and required taxes, medical benefits or your portion of medical benefits, retirement funds, savings funds, charitable contributions, etc. Let’s take a closer look at the breakdown of these deductions.

>Federal Withholding Tax: This is the amount of money that is calculated by law as your share of taxes paid. This amount will depend on the information you submitted on your W-4 when you were hired such as marital status and number of dependents as well as any other instruction you have given with regard to additional withholding amounts PLUS the amount of money that you earned.

>State Withholding Tax: This tax is an amount that is calculated depending on, your what? yes, that’s right — your gross pay. This amount is deducted from your paycheck to assist in funding governmental agencies within the state. We, here in Texas, do not pay state taxes because Texas is a tax-free state along with Florida, Alaska, Nevada, Washington, South Dakota, Wyoming, Tennessee and New Hampshire. Beware of this state tax if you are an individual who lives in a tax state and work in a tax-free state because even though your employer does not deduct state taxes from your paycheck because you work in Texas, your tax home state is still going to be looking at you to pay your state taxes (if you live in any state other than the few mentioned above).

>FICA: Here is the guy you don’t know and you want to know why he is taking all your money. Well, we are getting ready to find out. FICA stands for Federal Insurance Contribution Act. This tax includes two separate taxes — Social Security and Medicare. These two items may be combined on your paycheck as one deduction; however, in most instances, it is itemized separately. Let’s look at them separately.

~Social Security: This is considered the nation’s retirement program. This tax is taken from your paycheck every pay period to assist in providing retirement income for the elderly and it pays disability benefits to those in need. These taxes are calculated at a percentage rate. In 2011, this percentage was lowered from 6.2 percent to 4.2 percent. The annual wage limit remains at $16,800 of your salary for the year. Once that amount is earned, the employer will stop the withholding tax and will resume it when the new year begins.

~Medicare: For Medicare, the withholding percentage deducted did not change. It remains at 1.45 percent. Medicare does not have an annual wage limit like Social Security. Therefore, the employer will withhold this percentage from all of your paychecks the entire year.

~Employer’s Share: If you think IRS is just taking your money out of your paycheck, don’t be fooled. Your employer is paying as well. Employers are required also to pay Social Security and Medicare on wages that they pay to you. Unlike the reduction in percentage that you enjoy, the employer’s share of this tax did not decrease. They are still required to pay 6.2 percent instead of the 4.2 that you pay. For the Medicare part, the employer pays the same percentage as you. So, the employer pays his portion of Social Security and Medicare taxes, plus he also pays your withholding, together, to the IRS. Of course, he takes it out of your paycheck but he does not keep it. He just funnels it through to the IRS.

~Considerations: This is something else that not a lot of people know about and it is called the IRS Section 125 Plan. This is for such things as a medical or dental plan that meets the IRS’ Section 125 criteria and this plan is not subject to Social Security and Medicare taxes. If you have such a plan, then, the employer will subtract the non-taxable benefit from your gross pay before he makes his taxing calculations. The amount after subtracting this benefit is called the employee’s taxable wages. Your employer will then figure your withholding, Social Security and Medicare from this new amount. This requires the employer to file a form with the Social Security Administration showing your taxable wages on your W-2 form for the year and he is required to provide a copy of that form for you to file with your tax return with the IRS.

>Retirement Plan: This is a plan that you set up with your employer if you want money deducted from your paycheck every pay period to help fund your future retirement benefits. This is an amount that is sometimes matched by the employer. This could be a 401K, a state or even a local retirement plan. Government employees belong to public pension plans funded by taxpayers. Private companies also provide pension plans, but their funds are based on investment planning (stocks and bonds). Due to the poor economy, many companies are opting out of pension plans. They are now directing employees into defined-contribution plans in which the worker, not the employer, bears the risk of poor investment performance.

>Medical and Dental Health Plans: This is a plan that you decide whether you want deductions taken out or not. However, the employer has to offer such plans for you to take advantage of this. Therefore, if they do offer one, you need to decide what type of plan you need and what is the best medical and dental coverage for you and your family. A carefully selected health and dental plan can potentially reduce medical costs over the long term and give you peace of mind. Now, keep in mind, that your employer may pay for your health and dental plans OR they may pay a portion of it OR they may pay nothing. In this last case, you would be totally responsible for the price of the package you choose.

>Year-to-Date: Lastly, on your deductions is the YTD wages. This is the total gross pay you have earned to date. Some employers will not only show your cumulative gross pay, but your cumulative net pay as well along with your taxes, your deductions, sick leave, vacation time, etc.

If you ever want to double check your paycheck amount, know that if you add up your net pay, your taxes and all your deductions, it should equal your gross pay for that pay period.

Now, if you don’t want to pay taxes at all, ever again, read the article on the next three pages. I wrote this a couple of years ago; tell me what you think with regard to this new concept. I am curious to see if people would really like to see something like this happen. I think it’s great. My family and friends like it, so, again, tell me what YOU think! I look forward to your comments.

△

by cjxpadmin | Sep 18, 2012 | Octobe r2012 Magazine, This Issue's FEATURE

by Sheena Williams

Ahh holiday time! The sounds of tingling bells and children’s laughter! The presents, the calendar that says it’s August… What? August? I know what you’re thinking. The holidays are a long way off, but for retail and restaurants, the season is starting now! They are gearing up for the holiday season by hiring workers now. They are doing a push for staff so that when the masses come in to shop, they will not be short-handed. Who hates standing in lines for 8 hours to purchase two little items? Exactly, and employers hate when their customers have to do that as well. Even if the jobs are temporary, they have their own unique set of benefits that a more erudite worker can exploit!

long way off, but for retail and restaurants, the season is starting now! They are gearing up for the holiday season by hiring workers now. They are doing a push for staff so that when the masses come in to shop, they will not be short-handed. Who hates standing in lines for 8 hours to purchase two little items? Exactly, and employers hate when their customers have to do that as well. Even if the jobs are temporary, they have their own unique set of benefits that a more erudite worker can exploit!

Get Your Foot In The Door — So let’s say that you have been trying to work forever at this  shoe company as a shoe designer. They just aren’t returning your calls or trying to hear about your designs because they are very busy. They are, however, hiring for shoe lace demonstrators or shoe sales associates. What do you do? You apply for those positions! Not only is this a chance to accidentally show off your skills to someone who knows a guy who knows a guy at the head office, you are also getting to see if you like how the company operates. How a company treats its lowliest workers is a pretty good indicator of how the company works as a whole. This gives you the inside scoop and a way to get your foot in the door.

shoe company as a shoe designer. They just aren’t returning your calls or trying to hear about your designs because they are very busy. They are, however, hiring for shoe lace demonstrators or shoe sales associates. What do you do? You apply for those positions! Not only is this a chance to accidentally show off your skills to someone who knows a guy who knows a guy at the head office, you are also getting to see if you like how the company operates. How a company treats its lowliest workers is a pretty good indicator of how the company works as a whole. This gives you the inside scoop and a way to get your foot in the door.

Discounts And Sales — I don’t think I need to explain this one too much. Most retail companies offer major discounts for employees! Is that a leather wallet by some random design  house you’ve had your eye on? Is that a dress you think your daughter would look darling in? Don’t have a lot of money for Christmas gifts this year? By applying and getting a job with a retail store, you are being given the chance to get things that would normally carry a ridiculous price tag at some very nice discounts! You are also the first person to know about any sales that are upcoming, and a quick FYI to your parents or significant other could net you that long-lusted for item at a great price! Is that thinking too much about self? Yes, it is!

house you’ve had your eye on? Is that a dress you think your daughter would look darling in? Don’t have a lot of money for Christmas gifts this year? By applying and getting a job with a retail store, you are being given the chance to get things that would normally carry a ridiculous price tag at some very nice discounts! You are also the first person to know about any sales that are upcoming, and a quick FYI to your parents or significant other could net you that long-lusted for item at a great price! Is that thinking too much about self? Yes, it is!

Extra Cash — Even if you are working, sometimes, it never hurts to have a second viable income. You can stash away money in your savings account, go on that trip you’ve always wanted, help a family member with expenses or just build up a little nest egg for emergencies. Maybe you want to have a little extra to send to your child in college. Whatever the case, it never  hurts to have a little extra cheer, no matter what the season. Take advantage of it!

hurts to have a little extra cheer, no matter what the season. Take advantage of it!

Resume Builder — So, you need to learn a skill and you see a part-time job that will train you to do exactly that. Let’s say that you are a chef and there is a certain way a café makes their coffee, and you are dying to know how so that you can offer that service someday in your own 4-star restaurant. What do you do? That’s right, apply! It’s training that you are getting paid for and it looks amazing on your resume! See a nonprofit that needs a secretary? Sign up! You now have office experience to add to your list of experiences.

New Friends And Customer Service — Another reason for taking on seasonal jobs is that it gives some people something to do. Maybe you’re retired and you are just tired of being at the house all the time. A part-time or seasonal position may be just what you are looking for. It  keeps you active and others are learning from your experience. You are also getting the chance to make new friends. The camaraderie built in the workplace stems from the same reason that sports teammates are so close and have such a strong bond. You are a group of people working for a common goal. You are greeting and meeting people, and even if you are not retired, it will give you a place to hang your hat until the next job, the one you truly want, comes along.

keeps you active and others are learning from your experience. You are also getting the chance to make new friends. The camaraderie built in the workplace stems from the same reason that sports teammates are so close and have such a strong bond. You are a group of people working for a common goal. You are greeting and meeting people, and even if you are not retired, it will give you a place to hang your hat until the next job, the one you truly want, comes along.

Make sure to check your local Workforce Center listings to keep up with who is hiring. Stop by a local mall and check out who is hiring. You never know what you’ll find or what opportunities are out there for you! △

basis. Most applications are accompanied by additional precious employment documents, i.e. resumes, cover letter, vitas. It is when I actually have the opportunity to speak to interested candidates where an applicant’s “Blind Opponent” reveals itself in one of our mini visitations; thereby, making our meeting of two a threesome.

basis. Most applications are accompanied by additional precious employment documents, i.e. resumes, cover letter, vitas. It is when I actually have the opportunity to speak to interested candidates where an applicant’s “Blind Opponent” reveals itself in one of our mini visitations; thereby, making our meeting of two a threesome. appears desperate, tunnel-visioned and sometimes pushy for they are blind to the employer’s applicant processes, availability of jobs and they, most often, lack the knowledge of who the hiring decision-makers are within an organization. Current and future job opportunities are often talked away and, in most cases, right out of an applicant’s reach because the applicant replaces themselves with their Blind Opponent to speak on their behalf without first asking questions and listening to the employer.

appears desperate, tunnel-visioned and sometimes pushy for they are blind to the employer’s applicant processes, availability of jobs and they, most often, lack the knowledge of who the hiring decision-makers are within an organization. Current and future job opportunities are often talked away and, in most cases, right out of an applicant’s reach because the applicant replaces themselves with their Blind Opponent to speak on their behalf without first asking questions and listening to the employer.

Prepare in advance two open-ended questions that will provide you with information that you previously did not know about the organization’s employment processes, or about the organization itself. It can be helpful to understand who is responsible for reviewing applications, making hiring decisions and if their organization utilizes hiring timelines. Avoid asking closed-ended yes/no questions.

Prepare in advance two open-ended questions that will provide you with information that you previously did not know about the organization’s employment processes, or about the organization itself. It can be helpful to understand who is responsible for reviewing applications, making hiring decisions and if their organization utilizes hiring timelines. Avoid asking closed-ended yes/no questions. To gain positive attention, give the employer 80% talk time. The applicant should take no more than 20% talk time in an employer meet-n-greet informational meeting/interview. This percentage time would be reversed if it were an actual interview; however, this is just an initial meet-n-greet meeting. Employers are pleased whenever they find applicants who take an avid interest in their organization. When applicants approach employers about meetings to discuss specific job openings, employers typically become hesitant for they don’t want to be accused of disproportionately providing information to applicants amongst an applicant pool. So when asked about job openings, the employer will most likely begin rehearsing their commonly used response as to how the applicant may navigate through their website to get additional information. However, most employers love to share how they landed their jobs and how they recruit their best employees. Don’t assume you will get a job with an initial meet-n-greet meeting. Your goal is to gain a positive memorable experience.

To gain positive attention, give the employer 80% talk time. The applicant should take no more than 20% talk time in an employer meet-n-greet informational meeting/interview. This percentage time would be reversed if it were an actual interview; however, this is just an initial meet-n-greet meeting. Employers are pleased whenever they find applicants who take an avid interest in their organization. When applicants approach employers about meetings to discuss specific job openings, employers typically become hesitant for they don’t want to be accused of disproportionately providing information to applicants amongst an applicant pool. So when asked about job openings, the employer will most likely begin rehearsing their commonly used response as to how the applicant may navigate through their website to get additional information. However, most employers love to share how they landed their jobs and how they recruit their best employees. Don’t assume you will get a job with an initial meet-n-greet meeting. Your goal is to gain a positive memorable experience. utilize whatever time you have remaining (of your 20% talk time) to pitch your valuable work experience. Employers are very impressed when it appears you have listened to them. Even when an employer gives information that does not sound promising, stay positive and close the meeting with presenting your resume and a quick pitch about your work experience that summarizes why you are a viable candidate. Be organized and very clear in your speech. Provide eye contact and don’t forget to smile.

utilize whatever time you have remaining (of your 20% talk time) to pitch your valuable work experience. Employers are very impressed when it appears you have listened to them. Even when an employer gives information that does not sound promising, stay positive and close the meeting with presenting your resume and a quick pitch about your work experience that summarizes why you are a viable candidate. Be organized and very clear in your speech. Provide eye contact and don’t forget to smile.